Objective Financing

General Benefits

Unlock financial flexibility with AEON Credit Product Financing today!

No Credit Card Required

Flexible repayment tenure

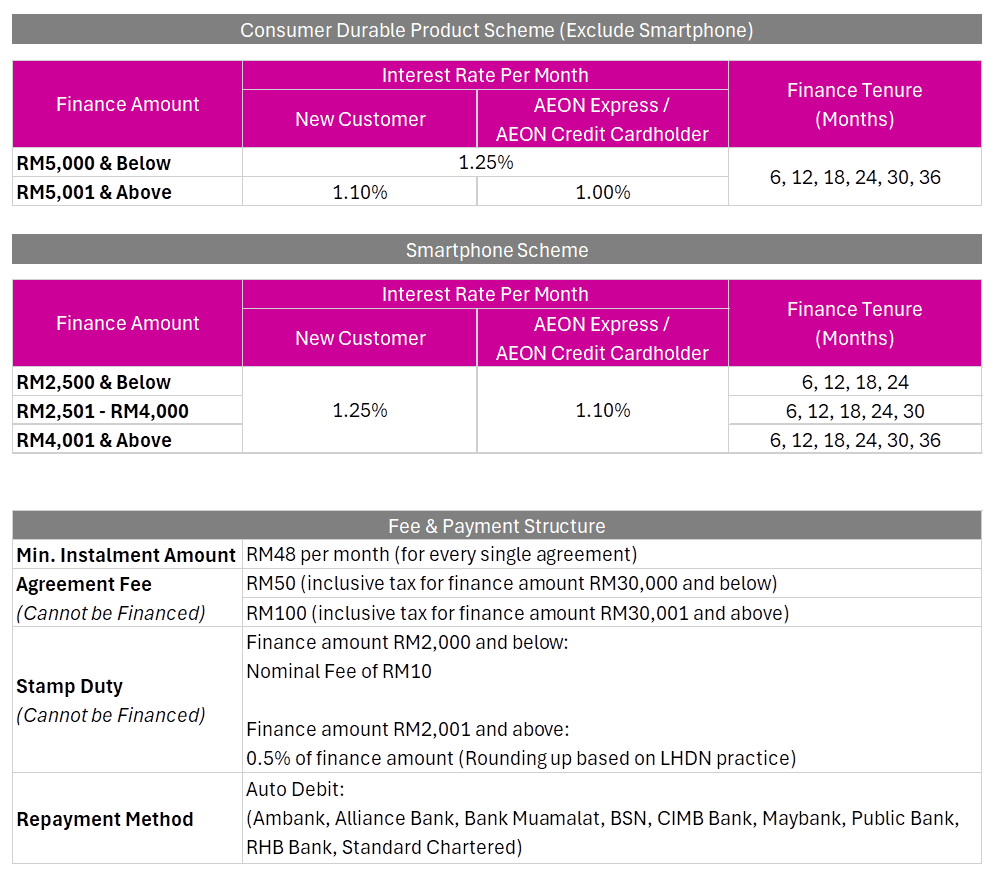

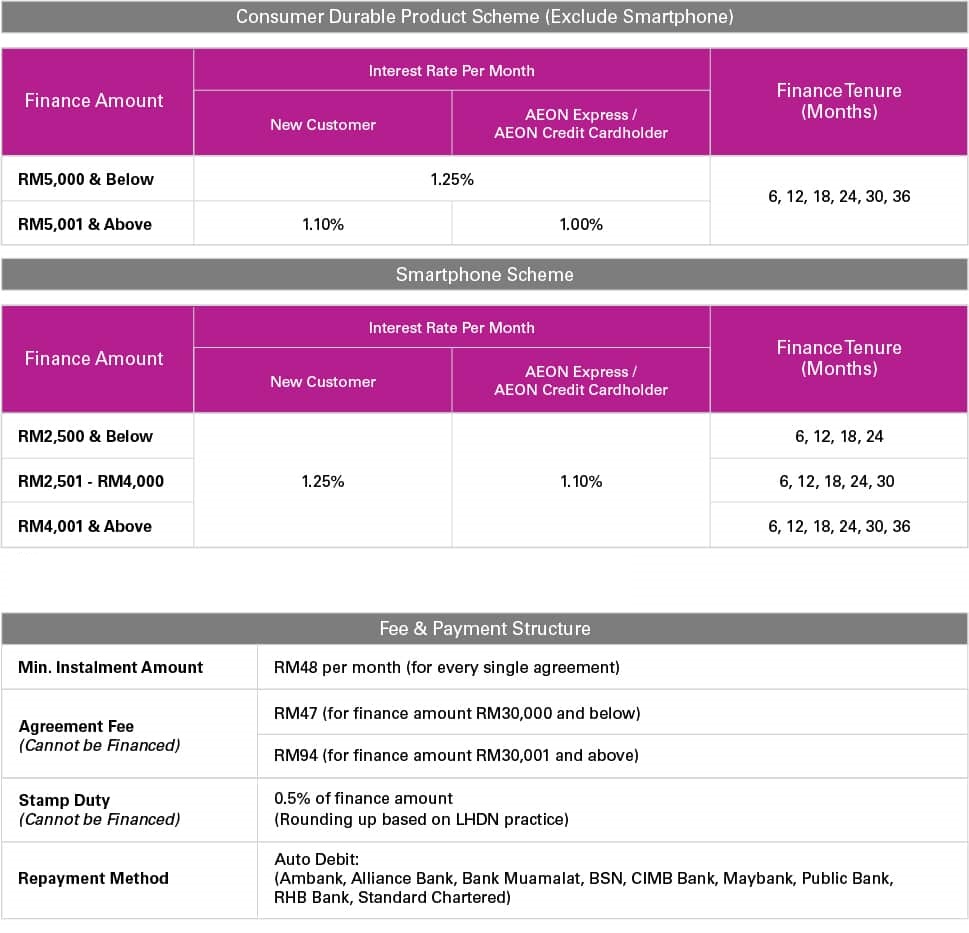

Monthly repayment as low as RM48

Features & Benefits

Affordable Monthly Repayment

as low as RM48

Special Interest Rate

Attractive monthly interest charge as low as 1.0% per month.

Flexible Repayment Tenure

Repayment tenure from 6 months to 36 months.

Nationwide Recognition

More than 5,000 merchants nationwide.

Eligibility & Required Documents

Eligibility

Individual:

- Malaysian citizen aged 18 to 65 years old

- Applicants should be employed for at least 6 months in current employment

- Minimum monthly gross income: RM1300

- Office telephone number and HP/home telephone number is compulsory

- One contactable referee

- Applicant must be contactable

Self-Employed:

- Malaysian citizen aged 18 to 65 years old

- Self-employed applicants' current employment must be at least 1 year

- Minimum monthly net pay: RM1000.00

- Office telephone number and HP/home telephone number is compulsory

- One contactable referee

- Applicant must be contactable

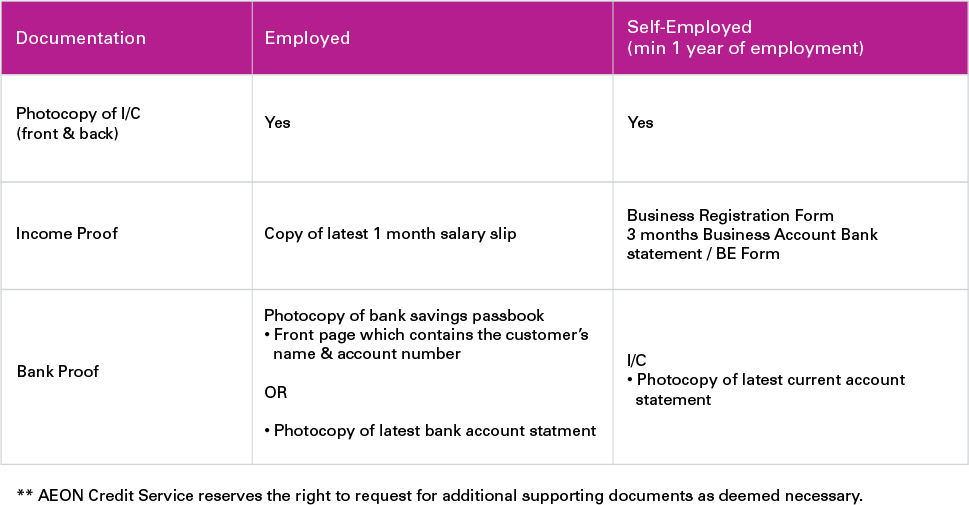

Documents Required

Individual Applicant:

- One photocopy of I/C (front and back).

- Photocopy of 1 month proof of income or EPF statement.

- Latest Bank Proof.

Self-Employed:

- Business Registration Form.

- Photocopied I/C of proprietor/partners/directors (front and back).

- Latest 3 months company bank statement.

Payment Methods

Deduction by Autodebit

Maybank, BSN, CIMB Bank, Public Bank, RHB, Ambank Group, Ambank, Alliance Bank, Bank Muamalat and Standard Chartered

Over the Counter

Available in all AEON Credit Service Branches

Cash Deposit Machine (CDM)

AEON Credit Service branches, Maybank, CIMB Bank, Public Bank and Alliance Bank

MEPS Interbank GIRO

Payment through MEPS Interbank GIRO at any participating banks and through Internet Banking

AEON Wallet Malaysia

Conveniently manage transactions and enjoy hassle-free payments across various merchants and services with your AEON Wallet Malaysia app

Product Scheme

FAQs

Explore our Frequently Asked Questions (FAQ) section to find comprehensive information about AEON Credit Product Financing.

- What is Objective Financing?

Objective Financing is a product financing for purchase of consumer durable products through our appointed nationwide merchants via flexible monthly instalments.

- What are the document requirements to apply for a loan?

- Where can I apply?

You may apply via our appointed AEON Credit Merchants nationwide.

- What products does the scheme finance?

Objective Finance Scheme cover wide range of products, ranging from Home Appliances, Kitchen Appliances, Home Entertainment, Furniture, Car & Motor Accessories, Bicycle, Smart Phones, Tablets, Digital Gadget, Computer & Laptop, Gold & Jewellery, Kitchen Cabinets, Water Filters, Musical Instruments, etc.

- What is the payment tenure for Objective Financing?AEON Credit Service provide flexible payment tenure from minimum of 6 months up to maximum of 36 months.

- Do I need to provide any guarantor?

No guarantor is required.

- How do I make my monthly payments?You can make your monthly payments via deduction by Auto debit, AEON Credit Service Branches, Cash Deposit Machine, MEP Interbank GIRO or Internet Banking, AEON Wallet.

- If I make an early settlement on my loan, will I enjoy an interest rebate?Yes. For more information, please contact our customer service centre at 03-2719-9999.

- Where can I find out more information on interest rates and fees etc?

Document Downloads

Loan Calculator

Our helpful tool to help you calculate your monthly instalments (subject to final approval).

Objective Financing

Apply for Objective Financing Today

Visit your nearest AEON Credit Service merchant now!