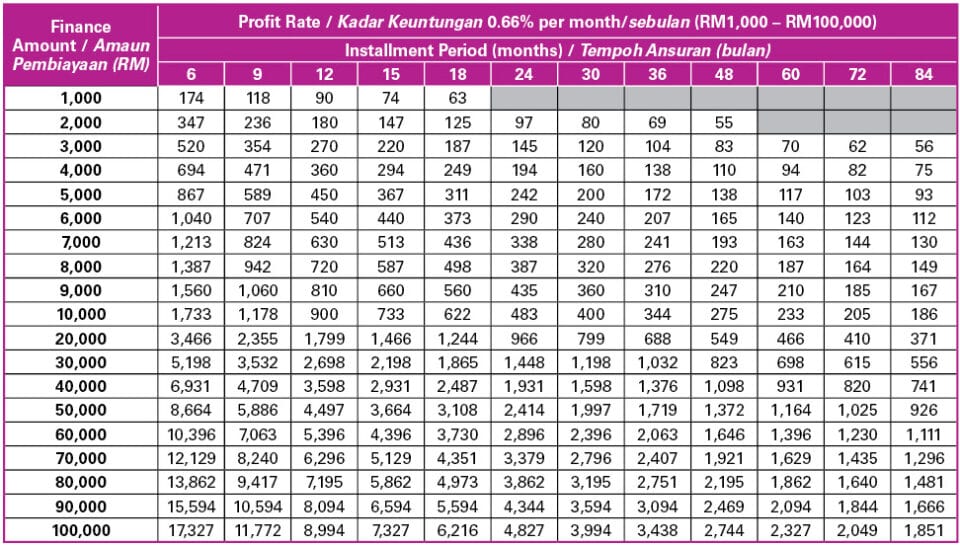

Table of Profit Rate/Kadar Keuntungan 0.66% per month/sebulan (RM1,000 – RM100,000)

Enjoy the convenience of Personal Financing-i that fulfils your needs. Get instant approval with a hassle-free application anytime, anywhere.

Low Instalment

High Financing

Up to 7 Years Tenures

Get your cash, even if it's a Sunday. No guarantor, collateral, or security deposit needed.

Finance up to RM100,000.

You can select Payment tenure of 6, 9, 12, 15, 18, 24, 30, 36, 48, 60, 72 and 84 months.

Using Commodity Murabahah transactions based on the Shariah principle of Tawarruq.

Very easy to apply. You just need to have relevant documents ready.

As low as 0.66% p.m*.

With minimal documents required, AEON i-cash is the perfect financing solution to meet all your needs!

Eligibility

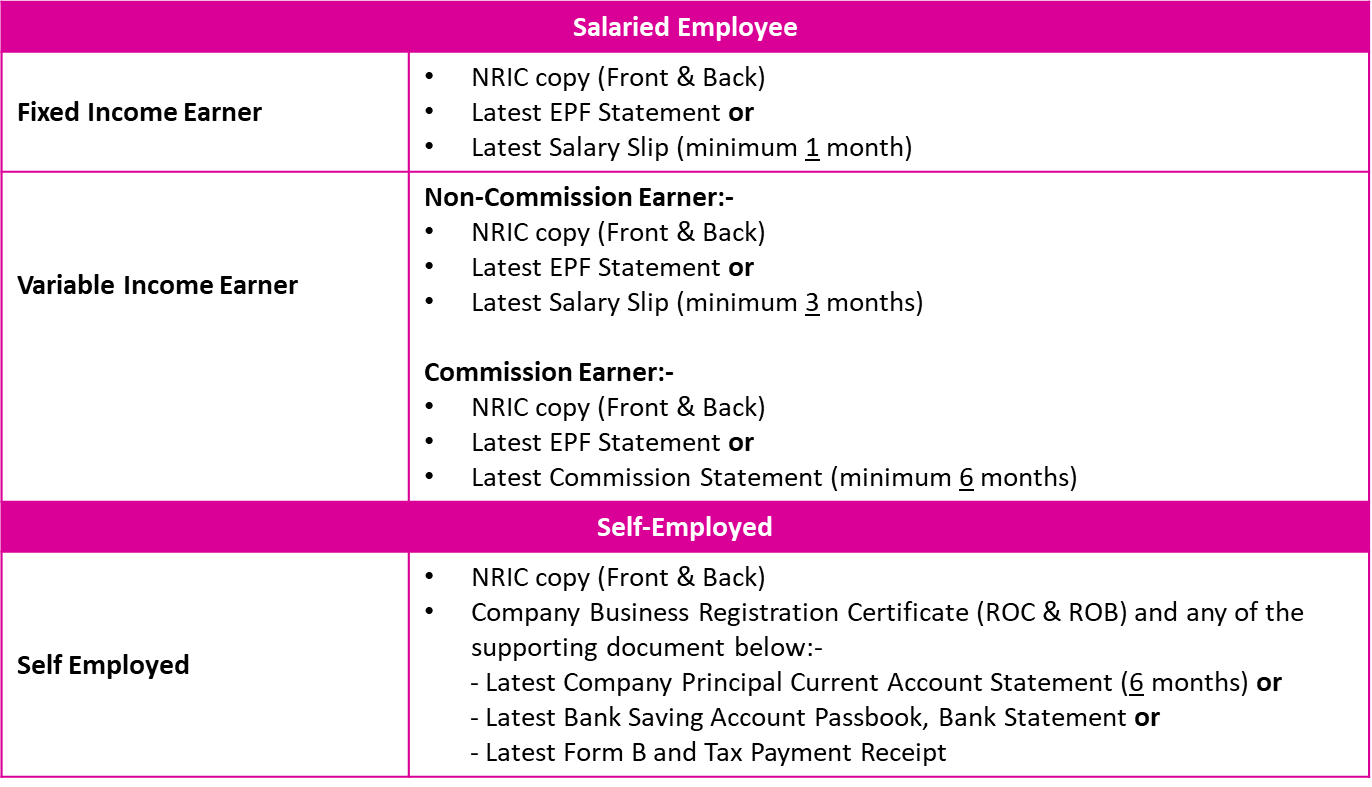

Documents Needed

Valid Email Address and Mobile Number

4% of the financing amount ≤RM10,000

2% of the financing amount >RM10,000

Maximum fee is capped at RM400

As per the Stamp Act 1949 (Revised 1989)

RM10.00

*All applicable taxes shall be payable by the customer (if any). For further detail please log on to www.aeoncredit.com.my

Instalment tables to guide you for your Personal Financing-i (from RM1,000 to RM100,000).

Notes:

*Actual financed amount may vary from the above tables

*Profit rate: 0.66% per month = 7.92% per year, (Effective rate): 13.57% - 14.31% per year

*Profit rate: 1.60% per month = 19.2% per year, (Effective rate): 28.97% - 33.73% per year

Explore our Frequently Asked Questions (FAQ) section to find comprehensive information about AEON Credit Personal Financing.

AEON i-Cash Personal Financing is an unsecured Islamic Financing that does not require any collateral.

The applicable Shariah concept is based on the Shariah principle of Tawarruq (Cost-Plus Deferred Sale of Commodities).

Minimum facility amount is RM 1,000.00, while the maximum facility amount is RM100,000.00. Facility amount approved is subject to AEON Credit’s assessment.

If Salaried Employee (Fixed Income Earner):

Front & back copy of NRIC and

Latest Salary Slip (1 month) or

Latest EPF Statement

If Salaried Employee (Non Commission based):

Front & back copy of NRIC and

Latest Salary Slip (3 months) or

Latest EPF Statement

If Salaried Employee (Commission based):

Front & back copy of NRIC and

Latest EPF Statement or

Latest Commission Statement (6 months)

If Self-Employed:

Front & back copy of NRIC and

Company Business Registration Certificate (ROC & ROB) and

Latest Company’s Principle Current Account Statement (6 months) or

Latest update Bank Saving Account Passbook or Bank Statement or

Latest update BE/E Form and Tax payment receipt

No, there is no security deposit required.

The facility approval is within 1 to 3 days. However, it is subject to full documentation and information received by AEON Credit. Terms and Conditions apply.

If the application is approved:

Customer will receive Enrolment Email & SMS from AEON Credit to complete the E-Mandate*

process if his/her application is approved.

*Note: Should E-Mandate is not able to be perform, please reach out to our CSU for assistance to perform paper

mandate.

If the application is rejected:

Customer will receive an SMS from AEON Credit on the unsuccessful application.

Upon completion of E-Mandate and E-Signature, The funds will be transferred to either the AEON Member Plus Card’s (AMP) account, Savings or Current account of the Bank selected by the customer.

For disbursement to AEON Member Plus Card (AMP) account:

For disbursement to Customer’s Bank Account (CASA):

It will be 30 days from the approval date.

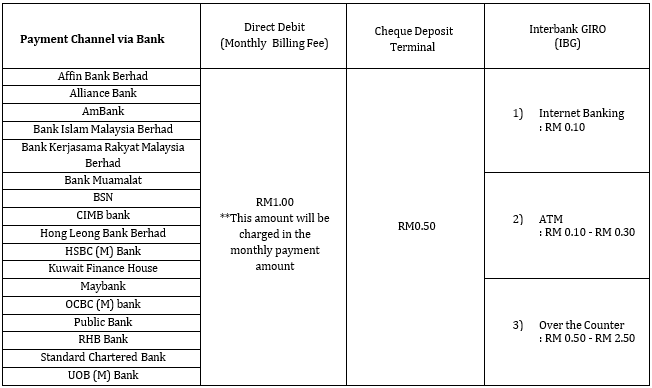

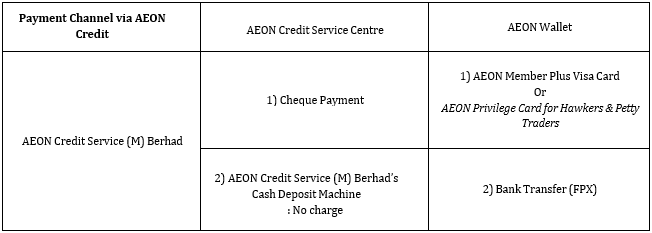

Check out our How to Pay section on the website for more details.

For PF applications that are successfully disbursed before 8 November 2022

• The payment is due on the 2nd of every month.

For PF applications that are successfully disbursed on/after 8 November 2022

• There are multiple payment due dates.

Compensation (late payment charge) will be imposed. If you are facing difficulties meeting your loan obligations, please contact us in advance to discuss repayment alternatives.

• If the customer fails to make any monthly instalments or pay any other amount payable when due or the outstanding Deferred Sale Price in full when demanded, the customer shall pay the Late Payment Charge (“LPC”) to AEON Credit based on the Shariah principle of Ta’widh (compensation) calculated at the LPC rate of one percent (1 %) per annum on the outstanding payments, from the overdue date until the date of full payment during the Tenure or until judgement date (whichever is earlier).

• The LPC shall be calculated based on the LPC rate as follows:

a) LPC = outstanding monthly instalments (or outstanding Deferred Sale Price) x LPC rate /365 days x numbers of days outstanding.

The LPC will not be compounded. The right to the LPC shall not prejudice any of AEON Credit’s other rights available under the terms of the Facility.

You can contact us via the form on the side of this page or our Customer Service Hotline at 03-2719-9999.

You can either call our Customer Service Hotline, log in with your username and password on ACSM website or check out the SMS Enquiries page for more information. Alternatively, customer may also check their outstanding balance via AEON Wallet App under Financing.

“E-Mandate” is a Direct Debit portal for customers to authorize auto deductions of AEON Credit Personal Financing from their Current/Savings Accounts. AEON Credit Personal Financing has 17 Panel Banks that customer can choose for Direct Debit enrolment. Direct Debit enrolment is a compulsory action before customer perform E-Signature.

“E-Signature” is a web portal, which consists of the Personal Financing facility details (Eg Financing amount, Purchase Price, Profit Rate, Tenure, Monthly Installment Amount, Final Installment Amount, Takaful Deduction Amount, Processing Fee, Stamp Duty Fee, Wakalah Fee and etc). Customer must Electronically Sign on AEON Credit Personal Financing Documents as acknowledgement and acceptance of the AEON Credit Personal Financing.

Direct Debit is an instruction from you to your bank, authorising AEON Credit Service (M) Berhad to collect payments from your account on your Personal Financing payment due date. RM 1 will be charge for successful Direct Debit enrolment. This charge will be refunded back to your PF account and added in your 1st payment.

Example: Your monthly payment is RM 500.00. On the 1st payment, it will be RM499.00; for following payment, it will be RM 500.00.

For more information on Direct Debit charges and other payment channels’ changes, please refer to ‘How do I make payment to my account’.

Note:

No. Customer cannot cancel the Personal Financing Application once he/she has performed electronic signature or after the completion of a commodity transaction, as the system has already completed the auto sales confirmation.

Yes, customer may review his/her S&P agreement and yearly statement (hereinafter referred to as “Documents”) at ACSM website. Customer is required to login/ sign up for the first time to access his/her account. Upon signing up/logging in, the customer may click the Personal Financing product under “My Account” and thereafter the “Documents” section to access review and/or download the documents required.

Our helpful tool to help you calculate your monthly instalments (subject to final approval).

Personal Financing

School fees? Starting a business? Medical costs? With up to RM100,000 financing available, you can provide for the people that matter most.