AEON BiG Visa Gold Credit Card

Swipe More, Save More with Cashback

Overview

Important Notice: Discontinuation of AEON Big Visa Gold Credit Card Issuance. Click here for more information

8% AEON Store Cashback

Get 8% Cashback on the 20th & 28th every month at AEON Stores & AEON BiG Hypermarkets

3X AEON Points

Earn 3X AEON Points at AEON stores and AEON BiG Hypermarkets

Dining Cashback

Enjoy 5% Cashback on Dining Transaction

3X AEON Points

Earn 3X AEON Points at AEON stores and AEON BiG Hypermarkets

Free Parking

Enjoy parking rebates up to 2 hours. Available at selected AEON Malls & AEON BiG Hypermarkets.

Credit Card Requirements

Minimum Age & Annual Income

- Principal: 21 years old

- Supplementary: 18 years old

- Minimum Annual Income: RM36000 (for Malaysians)

- Minimum Annual Income: RM48000 (for Japanese, Malaysian PR, and MM2H applicants)

Documents Required (Non-Returnable)

- MyKad photocopy (both sides) for both Principal & Supplementary applicant(s).

- Latest 3 months salary slip/EPF statement/Form BE (with tax payment receipt)/Form EA for employed.

- Latest 6 months salary slip/EPF statement/Form BE (with tax payment receipt)/Form EA for commission-based salary.

- Business Registration Certificate or Form 9/24/49 & latest 6 months company's bank statements/Form B (with tax payment receipt) for self-employed.

Valid Email Address and Mobile Number

- Principal & Supplementary card applicant is required to have a valid email address and mobile phone number for verification purposes.

- A Verification Code will be sent to applicant for the sole purpose of details verification in order to complete the application process.

- If application is made via the Telemarketing channel, AEON Credit Telemarketing Officer will contact the applicant to confirm on the Verification Code.

Features and Benefits

Important info about AEON BiG Visa Gold Credit Card.

- 2X AEON Points at every RM2 spent at AEON Stores (AEON retail, MaxValu, Daiso (by AEON), Komaiso, AEON Delight, MyAEON2Go, AEON Fantasy, AEON Wellness), and AEON BiG Hypermarkets every day (except 20th and 28th).

- 1X AEON Point for every RM1 spend for member recognition in all AEON Stores, AEON BiG Hypermarkets, AEON Maxvalu Prime, AEON Wellness and Daiso (by AEON).

- 1X AEON Point for every RM4 spend on other transaction exclude dining, petrol, government department, trading, utility bills, and all fees and charges related transactions.

- 3X AEON Points for every RM2 overseas spend*.

Accumulate your AEON Points and convert it into cash at the conversion rate of 200 AEON Points = RM1.

- 8% Cashback on AEON Thank You Day at AEON Stores (AEON retail, MaxValu, Daiso (by AEON), Komaiso, AEON Delight, MyAEON2Go, AEON Fantasy, AEON Wellness), and AEON BiG Hypermarkets on the 20th & 28th of every month.

- Cashback is capped at RM100 per card account per calendar month.

- Applicable to dining transactions with MCC 5812 and 5814.

- Capped at RM25 per card account per calendar month.

- Effected in MYR currency only.

- Enjoy 3X access in a calendar year to Plaza Premium Lounge in Malaysia for Principal Cardholder.

- Spend min RM500 in single or cumulative transactions within 30 days before and/or after PPL entry date.

*This Insurance is underwritten by MSIG MALAYSIA and subject to terms and conditions of the respective master policies.

- Activate and spend virtual credit card instantly, while waiting physical card delivery.

- Conveniently accessible via AEON Wallet.

- Enjoy up to 2 hours of free parking with your AEON BiG Visa Gold Credit Card at selected AEON Malls and AEON BiG Hypermarkets. Subject to 10% convenience service fee and 6% SST.

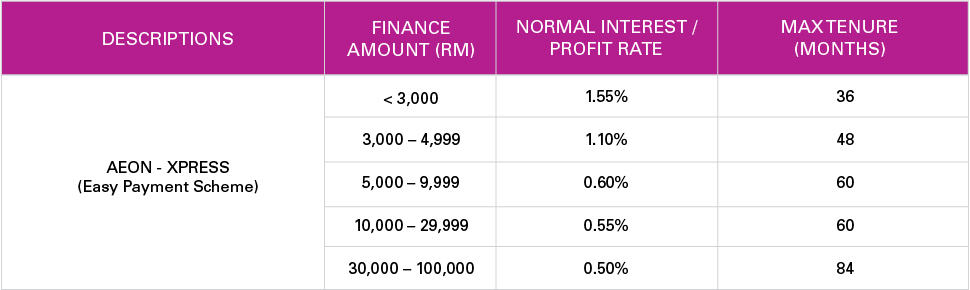

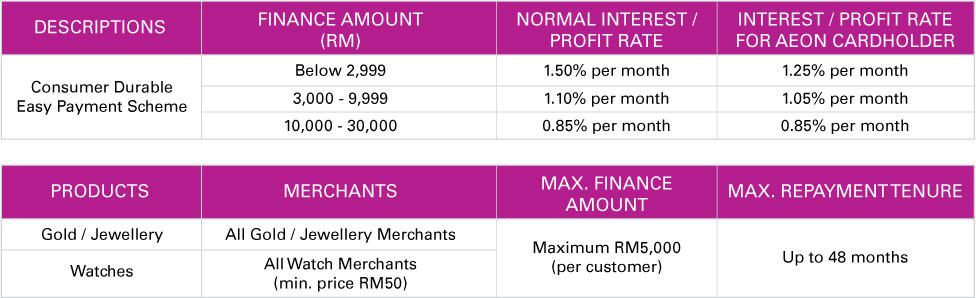

There is no processing fee and penalty for early settlement of your AEON Ready Cash plan.

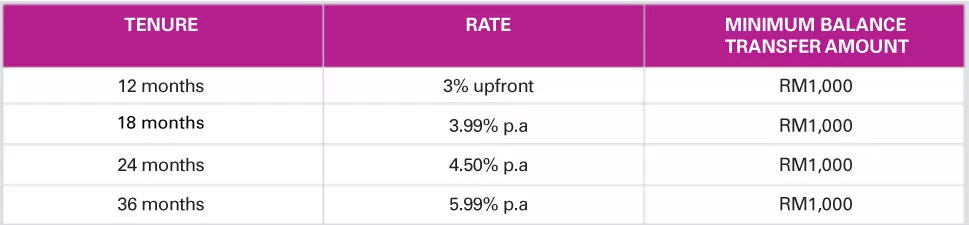

Consolidate your outstanding balances from other credit cards and transfer it to your AEON card at lower interest rate.

There is no processing fee and penalty for early settlement of your AEON balance transfer plan.

** If you make full monthly payment of your Balance Transfer instalments For more Information, call 03-2719 9999

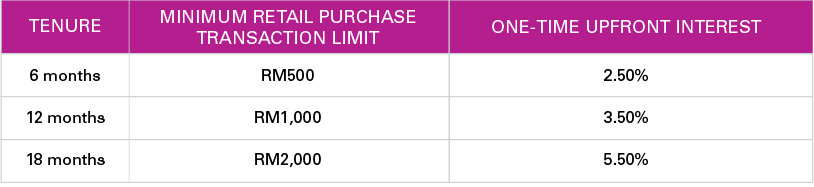

Transactions that have not been posted or stated in the current month’s statement can be converted to a Flexible Payment Plan after three working days from the date of purchase.

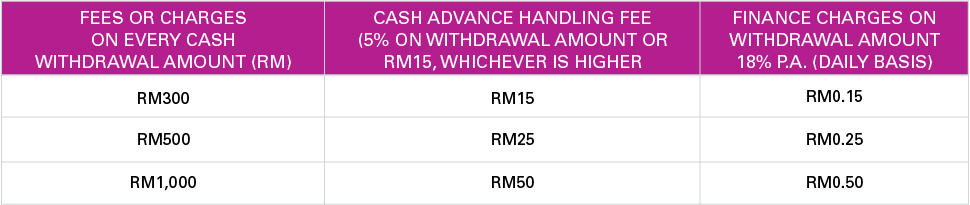

Stop worrying and start living your life! AEON Credit Cash Advance offers instant cash anywhere, anytime. It’s that simple and convenient!

New credit limit to suit your standard of living

2-months for overseas travel, medical, education, hospitalisation, and compassionate purposes

Supplementary – RM60*

*First year waived, subsequent year waived with minimum of 12 transactions per year.

No processing/penalty fee for early settlement of your AEON Balance Transfer.

No processing/penalty fee for early settlement of Ready Cash.

- No SST.

- No annual fee.

- No replacement card fee.

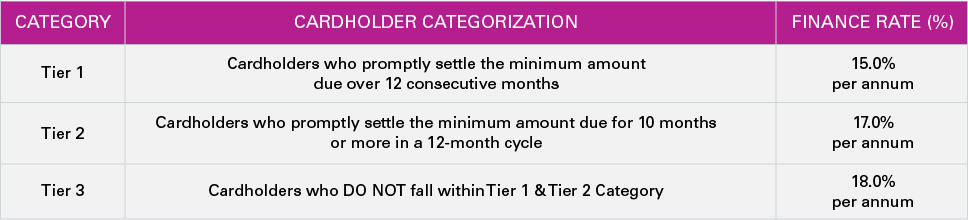

- BNM tiered interest rate (same as physical card).

P.O.Box 12754,50788 Kuala Lumpur

Fax : 03-7863 7898

AEON BiG Visa Gold Credit Card

Swipe More, Save More with Cashback