Benefits

Here are reasons why you'll love AEON Care.

Worldwide Coverage

Whether you are at home or abroad, you can rest assured that we've got you covered in the event an accident happens

Affordable Premiums

For as little as RM0.30 a day, you can get peace of mind, knowing that if anything were to happen to you or your family, the cost of paying for an accident will be of no issue

No Upfront Medical Checkup

With AEON Care, there is no upfront medical checkup required. Save the hassle and some money and get the protection you need rightaway

Important Information

Important info about AEON care

Accidental Death / Permanent Disablement

Lump sum compensation for death or permanent disablement as a result of an external, forcible, violent event against you that is unforeseen, fortuitous and not premeditated.

Medical Expenses due to Accidents or Theft Injuries

Reimbursement of actual medical surgical and hospital fees necessarily and reasonably incurred for medical treatment in a hospital or a legally licensed clinic in respect of accidental bodily injury.

Ambulance Fees Benefits

Reimbursement of charges by hospital or private ambulance company for emergency/ambulance response and treatment on the Insured in respect of any accidental bodily injury.

Bereavement Allowance due to Accident

Lump sum compensation for accidental death.

Daily Hospital Cash

Daily cash allowance for each complete day of confinement in the hospital for treatment of bodily injury resulting from a covered accident.

ATM Assault and Robbery

Reimbursement for loss of cash withdrawn or cash you are forced to withdraw from your account via the use of an automated teller machine (ATM) when under any threat by an unknown person/persons occurring at the ATM or within fifteen (15) minutes of withdrawal from an ATM.

Outstanding Loan Amount

Payment to AEON Credit Service for the outstanding loan amount due under the Personal Loan Agreement between you and AEON Credit Service and any excess amount therefore shall be paid to you in the event you suffer either Death or Permanent Disablement due to an accident.

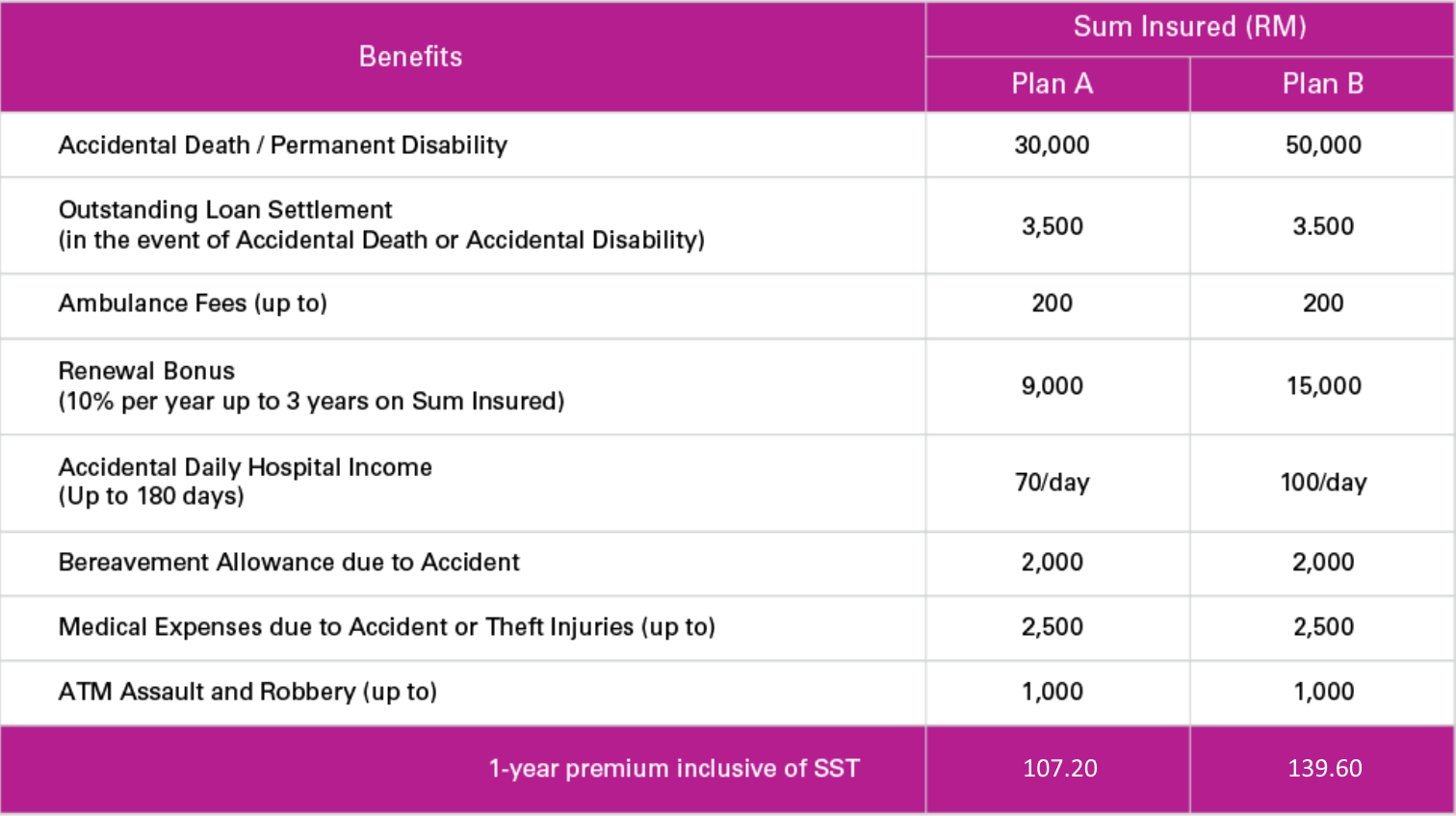

Schedule of Benefits

General Exclusions

Main exclusions under the plan include but are not limited to war, terrorism, suicide, intentional self-inflicted injuries, whilst under the influence of drugs dangerous / professional sports, any pre-existing physical or mental defect or infirmity, criminal or unlawful act, whilst traveling in an aircraft qas a member of the crew, whilst engaging in naval, military and/or air force services or operations.

Additional Information

Aeon Care is underwritten by Tokio Marine Insurans (Malaysia) Berhad, Registration No. 198601000381 (149520-U).

Aeon Care is arranged and managed by AEON Insurance Brokers (M) Sdn. Bhd.

Registration No. 198201005186 (84938-X).