AEON Credit Executive Business Card (by invitation only)

The Card for All Your Business Needs

Apply Now

Overview

With our Cashback, you’ll be bringing home spare cash, not just groceries.

AEON BiG & AEON Co.

Up to 1% Cashback on all retail transactions from AEON Co. and AEON BIG Stores

Cashback

0.5% Cashback on other retail transactions (excluding petrol and government services)

Premium Lounge

Complimentary 6X access to Plaza Premium Lounge for Cardholder with minimum spend RM500

Calculate Your Savings

Our helpful tool to help you calculate your savings when spending with our AEON credit card.

Savings Calculator

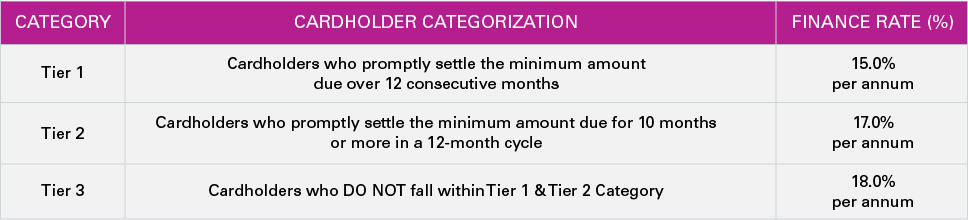

Category

Monthly Expenditure

Yearly Cashback (RM)

AEON BiG & AEON Co.

1% cashback

Retail

0.5% cashback

Excluding petrol and government services.

Total Yearly Cashback (RM)

Credit Card Requirements

Minimum Age & Requirements

- 21 years old

- The business entity must be in operations for at least two (2) years.

- For companies, minimum shareholder funds must be at least RM50K.

Documents required (non-returnable):

Private Limited Company (Sdn Bhd)/Public Limited Company (Bhd):

- Photocopy of MyKad/MyPR (front & back) or valid (non-expired) Passport of all appointed Director(s) and all Guarantor(s).

- Certified True Copy Form 8/Form 9 Section 32.

- Certified True Copy Form 24/Section 78.

- Certified True Copy Form 49/Section 58.

- Certified True Copy Memorandum and Articles of Association/Section 32.

- Latest 6 months Bank Statement.

- Latest 1 year latest Audited Financial Statement.

- Credit Bureau consent letter.

Sole Proprietor/Partnership:

- Photocopy of MyKad/MyPR (front & back) or valid (non-expired) Passport of Proprietor/all Partner(s).

- Credit Bureau consent letter.

- Latest 6 months Bank Statements.

- Latest Form B/Form P with official tax receipt.

- Peninsular Malaysia: Latest Suruhanjaya Syarikat Malaysia (SSM) print out and latest Business License; OR Sabah: Latest Trading License; OR Sarawak: Business Registration Certificate, Latest Business License and extract of Registration of Business name.

Limited Liability Partnership:

- Photocopy of MyKad/MyPR (front & back) or valid (non-expired) Passport of appointed Partner(s)

- Certificate of Registration with CCM

- Latest Certificate of Good Standing

- Latest 6 months Bank Statements

- Latest Form P with official tax receipt

- Credit Bureau consent letter

Features and Benefits

Important info about AEON Credit Executive Business Card (by invitation only).

- 1% Cashback on all retail transactions from AEON Co and AEON BiG stores.

- 0.5% Cashback on other retail transactions (excluding petrol and government services)

- Indulge yourself in a moment of relaxation; enjoy 6x complimentary access to Plaza Premium Lounges for a year at participating lounges in Malaysia.

- Spend min RM500 in single or cumulative transactions within 30 days before and/or after PPL entry date.

Only request for last 3 months will be entertained.

*This Insurance is underwritten by MSIG MALAYSIA and subject to terms and conditions of the respective master policies.

AEON Credit Executive Business Card (by invitation only)

The Card for All Your Business Needs

Apply Now