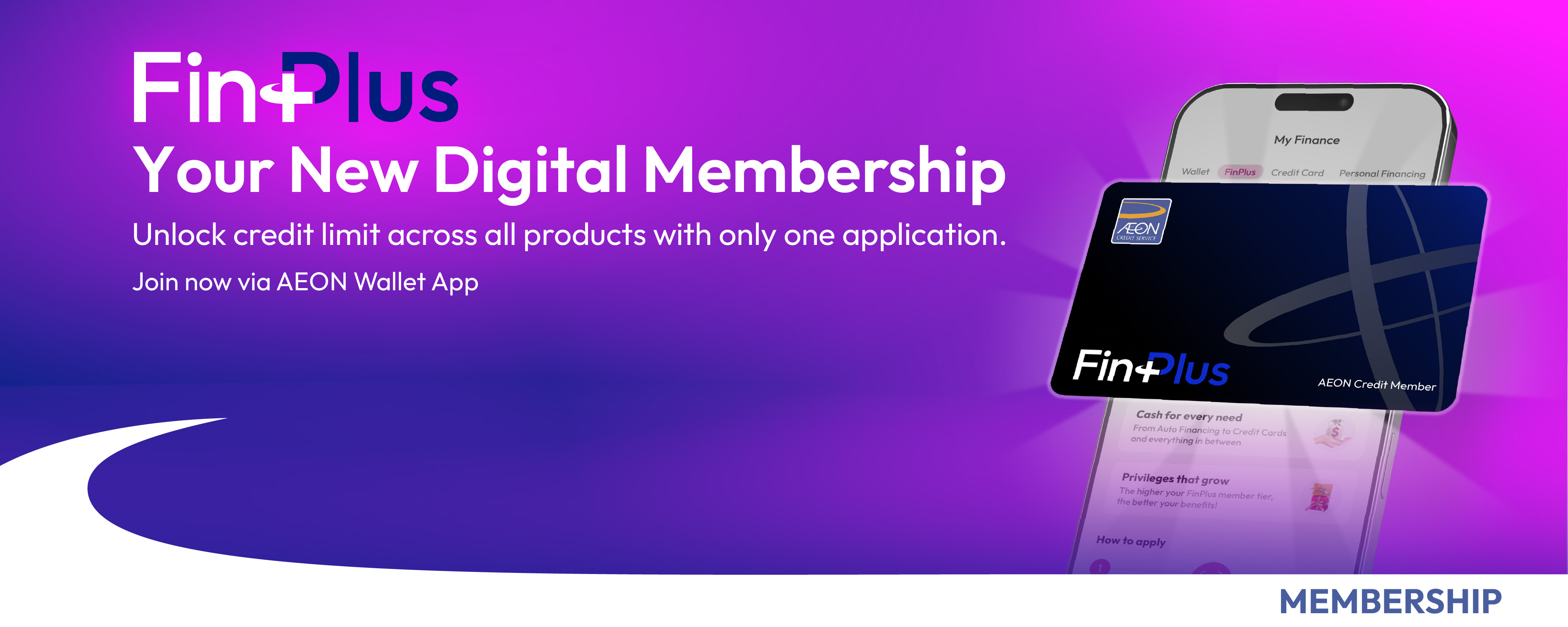

Your New Digital Membership

Unlock credit limit across all products with only one application.

Join now via AEON Wallet App

Overview

Unlock your tier and access your credit limit(s) instantly, all through AEON Wallet Malaysia app.

Unlock Your FinPlus Membership Tier

Join now via AEON Wallet Malaysia app to unlock your FinPlus tier and enjoy exclusive privileges. The higher your tier, the greater your credit limit(s) and rewards.

Get Your Credit Limit(s) in Just 5 Minutes!

Enjoy a ready-to-use limit across eligible AEON Credit products — it’s fast, easy, and seamless.

Join Anytime, Anywhere

Everything happens in the AEON Wallet Malaysia app — no documents required, no branch visits, just join via AEON Wallet Malaysia app.

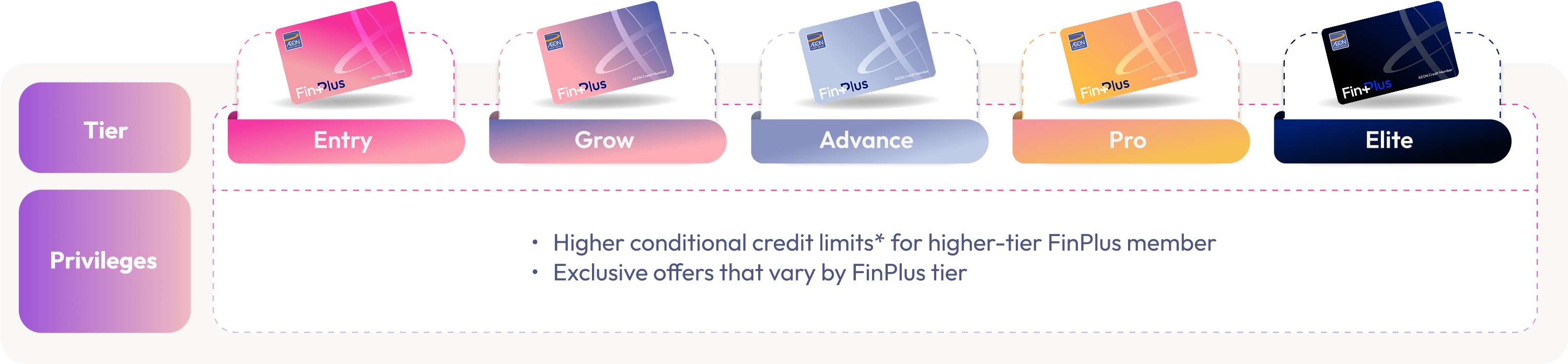

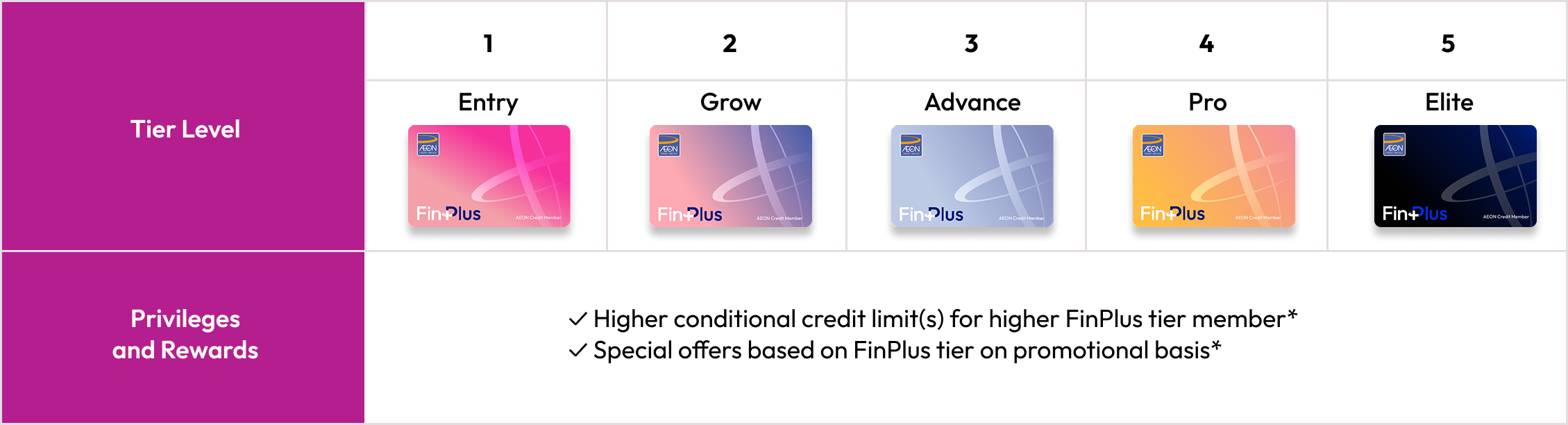

FinPlus Tiers & Privileges

Get a higher credit limit as you grow your tier! Elevate your tier by maintaining good credit.

*Conditional credit limit(s) are the pre-assessed credit limit(s) of our financing products and credit cards and are subject to final approval upon the assessment of each respective product applications.

**FinPlus is eligible for Malaysians aged 18 and above.

***FinPlus tier and conditional credit limit(s) assigned are subject to our internal assessment and discretion.

Hold on tight, more rewards are dropping soon! Stay tuned.

How It Works

Find out how to join FinPlus and turn your good credit into valuable rewards.

Your Next Move?

Join FinPlus Membership via

AEON Wallet Malaysia app

Frequently Asked Questions

- Finplus Membership

- What is FinPlus?

- Who is eligible to apply for FinPlus?

- Malaysian with age 18 and above*

- Completed identity verification with AEON Credit Service Malaysia via AEON Wallet

Malaysia App** - How can I apply for FinPlus?

- How long does it take to process my FinPlus application and how do I check for the approval status?

- Approved: Your FinPlus tier and your available conditional credit limit(s) will be displayed immediately.

- Declined: You are not eligible to be FinPlus member at this moment, hence FinPlus tier and credit limit(s) are not assigned to you.

- What do I enjoy as a FinPlus member?

- Instant conditional credit limit(s) of AEON Credit Malaysia financing products and credit cards. Customers with higher tier will be assigned with higher conditional credit limit(s).

- Special offers based on FinPlus tier on promotional basis.

FinPlus is a membership offered by AEON Credit Service (Malaysia) Berhad that is open to our new and existing customers. FinPlus membership application is subject to approval and upon approval you are deemed a FinPlus member. Each FinPlus member will be assigned with a tier which determines your exclusive privileges and rewards with us. You may apply and check your FinPlus tier, exclusive privileges and rewards through AEON Wallet Malaysia app.

Below customers are eligible to apply for FinPlus Membership:

Note: FinPlus application approval is subjected to AEON Credit Service discretion.

*Customer age 18 and above is eligible to apply for FinPlus membership, however application of each respective product is subjected to the respective product eligibility requirements. You may check the eligibility of the product in our website at https://myaeoncredit.com.my/

**Identity verification must be completed through AEON Wallet Malaysia app. This process may involve uploading your Identification (ID) photo and taking a short selfie video.

Apply for FinPlus and enjoy the member privileges and rewards via AEON Wallet Malaysia app.

Step 1: Download and register AEON Wallet Malaysia App.

Step 2: Select My Finance and click FinPlus tab.

Step 3: Click “Get Your Credit Limit Now”

Step 4: Verify your identity by performing e-KYC if you have not performed e-KYC via AEON Wallet Malaysia app.

Step 5: Provide your gross salary* and net salary**.

Step 6: Accept our terms and conditions and click submit.

Step 7: Thank you for your application! Your application will be processed within 48 hours, and you are a FinPlus member upon approval.

* Basic salary plus any additional allowances or overtime pay as per your latest income pay slip.

** Your Gross Salary upon deductions as per your latest income pay slip. Deductions may

include taxes, social security, or health insurance (such as SOCSO etc.), retirement contributions (such as pension, Employee Provident Fund etc.) or other deductions from our gross salary in your income pay slip.Note: Your FinPlus application will be assessed based on AEON Credit Service Malaysia assessment and discretion.

Once your application is submitted, we will process your application within 48 hours. Upon approval, your FinPlus tier and conditional credit limit(s) will be updated immediately via AEON Wallet Malaysia app. Hence, please check your FinPlus application status via AEON Wallet Malaysia app from time to time through AEON Wallet Malaysia App in FinPlus page.

Note: Please note that FinPlus membership is subject to eligibility requirements and may be cancelled if your credit profile does not meet our internal criteria.

Eligible FinPlus member may enjoy below privileges: –

Note: The benefits are offered to the selected eligible customers by AEON Credit Service (M) Berhad.

- Finplus Tier And Finplus Member Privileges

- How many tiers does FinPlus have and how does it work?

- Granted with RM30,000 credit card conditional credit limit.

- Awarded with 10% discount voucher.

- Granted with RM100,000 credit card conditional credit limit.

- Awarded with 50% discount voucher.

- Where do I check my FinPlus tier and benefits?

- Can my FinPlus tier change?

- What is conditional credit limit(s) and how can I utilize it?

- Credit Cards

- Personal Financing-i

- Motorcycle Financing HP-I, further categorized to: –

- Moped Financing-i (<250cc)

- Superbike Financing-i (≥250cc)

- Auto Financing HP-i

- Objective Financing-I, further categorized to.: –

- Smartphone & Gadgets Financing

- Home & Lifestyle Product Financing

- Can the conditional credit limit(s) granted expire?

- Is the granted conditional credit limit a final approved credit limit?

- How can I increase my credit limit(s)?

- I have applied for FinPlus membership, why am I not assigned with any FinPlus tier and no conditional credit limit(s) are granted?

- How many times can my FinPlus tier and credit limit(s) be re-assessed?

- What are the special offers available to FinPlus members?

There are 5 different FinPlus tiers, the highest tier is “Elite”. Your FinPlus tier will be automatically assigned once application is approved. FinPlus tier is determined based on your credit profile, this may include your financial behaviour of your existing or past products. FinPlus tier and credit limit(s) assigned are subject to our internal assessment and discretion.

Higher FinPlus tier shall be granted with more privileges and rewards.

For example: –

Customer A: FinPlus approved with Entry tier.

Customer B: FinPlus application approved with Elite tier.

*Terms and conditions apply.

You may check your FinPlus tier and benefits via AEON Wallet Malaysia App.

Yes, FinPlus membership tier can be upgraded or downgraded depending on your credit profile such as your repayment behaviour of your financial products. You may also check on your latest FinPlus tier by clicking on the “Refresh Credit Limit” button via AEON Wallet Malaysia app, we will update your latest FinPlus tier within 48 hours upon re-assessment.

Conditional credit limit(s) is a pre-approved credit limit(s) assigned for our financing products and credit cards based on preliminary assessment on your credit profile. Conditional credit limit(s) are denominated in Ringgit Malaysia (RM) and subjected to changes upon any updates to your credit profile during the actual submission of the application(s).

The conditional credit limit(s) will be assigned based on the list of products as below: –

Your conditional credit limit(s) can be granted either for all or some of the selected products, based on your eligibility. In the event you are not eligible, no credit limit will be granted for any of the products. You may select your preferred product(s) and navigate to the specific product application form or merchant finder to locate the nearest merchant to you. Next, you may then proceed to submit your application with an amount equal or less than the conditional credit limit(s) granted, subject to the maximum financing of the product(s).

Yes, conditional credit limit(s) granted has a validity of up to 30 days from the date of FinPlus application approval.

No. The conditional credit limit(s) granted are indicative based on preliminary assessment and subjected to AEON Credit Service Malaysia final assessment of each respective product application upon full application submission.

Your conditional credit limit(s) may increase based on your repayment eligibility and as you elevate your FinPlus tier. Additionally, you may also click “Refresh Credit Limit” and update your latest income details via AEON Wallet Malaysia app to obtain your latest conditional credit limit(s).

FinPlus tier assignment and conditional credit limit(s) are assigned based on our internal assessment and discretion. You will not be assigned a FinPlus tier and conditional credit limit(s) if you do not meet our eligibility criteria.

You may request your FinPlus and conditional credit limit(s) to be re-assessed up to 3 times within 30-calendar days validity of your current available credit limit(s), of which it will expire after that. Subsequently, you may request to re-assess your credit limit(s) again up to 3 times within the next 30-calendar days.

The special offers are varied based on your FinPlus tier and will be announced to you from time to time via our website and AEON Wallet Malaysia app.

- Others

- Can I transfer my FinPlus membership and benefits to someone else?

- Is there a fee charged for my FinPlus membership?

- Are there any hidden charges or additional costs?

- Can I cancel my FinPlus membership?

- Does my FinPlus membership expire?

No, your FinPlus membership is non-transferable.

No, FinPlus membership is free of charge to all eligible members.

No, there are no hidden charges. All benefits are included based on your tier.

No, you will not be able to cancel your FinPlus membership. However, we may cancel your membership if the FinPlus eligibility requirements are not met.

No, FinPlus membership will not expire after you join as a member. However, we may cancel your membership if the FinPlus eligibility requirements are not met.