Overview

With AEON Biker Infinite Visa Cards, every ride fuels your journey to greater rewards.

8% Cashback

Earn cashback on spare parts, accessories, merchandise, and motor services

8% Cashback

Earn cashback on overseas spend

2% Cashback

Earn cashback for petrol and insurance transactions

Plaza Premium Lounge

8x Complimentary Access to Plaza Premium Lounge

VIP Access

Enjoy privileges at motorcycle events, rallies, group rides, selected dealers and bike shows

Visa Concierge

Experience luxury at your fingertips with Visa Concierge

Virtual Card

Immediate access upon card approved

Credit Card Requirements

Minimum Age & Annual Income

- Principal: 21 years old

- Supplementary: 18 years old

- Minimum Annual Income: RM90000 (for Malaysians)

- Minimum Annual Income: RM90000 (for Japanese, Malaysian PR, and MM2H applicants)

Documents Required (Non-Returnable)

- MyKad photocopy (both sides) including Supplementary card applicant(s) MyKad (if applicable).

- Latest 3 months payslip/Form BE (with tax payment receipt)/EA/Latest 6 Months payslip for commission earners.

- Business Registration Certificate or Form 9/24/49.

- Latest 6 months Company Bank Statements/Form B with tax payment receipt.

Valid Email Address and Mobile Number

- Principal & Supplementary card applicant is required to have a valid email address and mobile phone number for verification purposes.

- A Verification Code will be sent to applicant for the sole purpose of details verification in order to complete the application process.

- If application is made via the Telemarketing channel, AEON Credit Telemarketing Officer will contact the applicant to confirm on the Verification Code.

Features and Benefits

Important info about AEON Biker Infinite Visa Card.

- Applicable to transactions with MCC 5532, 5533, and 5571.

- Cashback is issued in MYR currency only.

- Valid for transactions in foreign currency only, upon conversion to MYR.

- Applicable to transactions with MCC 5541 and 5542.

- Cashback is issued in MYR currency only.

- Capped at RM20 per card account per calendar month.

- Applicable to transactions with MCC 5960 and 6300.

- Cashback is issued in MYR currency only.

- Capped at RM20 per card account per calendar month.

- Applicable to all transactions except those listed above and e-wallet top-ups.

- Cashback is issued in MYR currency only.

Notes:

- Total cashback is capped at RM100 per month, including supplementary and virtual card spend.

- Cashback will be credited and reflected in the following month’s statement.

- Enjoy 8x complimentary access per calendar year to Plaza Premium Lounge for Principal Cardholders in Malaysia,

Thailand, Singapore, Japan, China, Hong Kong, and Indonesia. - Principal Cardholders are allowed to bring one (1) accompanying guest per entry.

- Spend a minimum of RM500 (single or cumulative transactions) within 30 days before and/or after the Plaza Premium Lounge entry date.

- Activate and spend your virtual credit card instantly, while waiting for your physical card to arrive.

- Conveniently accessible via AEON Wallet.

- Enjoy access to Visa Concierge, a premium service designed to make your life easier.

For inquiries and bookings, please contact the following channels:

Visa Concierge website: https://www.concierge-asia.visa.com/

Toll-free hotline: 1800 805 574

WhatsApp: +60 1800 805 572

- Complimentary coverage up to RM500,000 for travel accidents, 24-hour personal accidents, ambulance fees, and travel delays.

- Enjoy exciting privileges and offers at selected motorcycle dealers and merchandise stores.

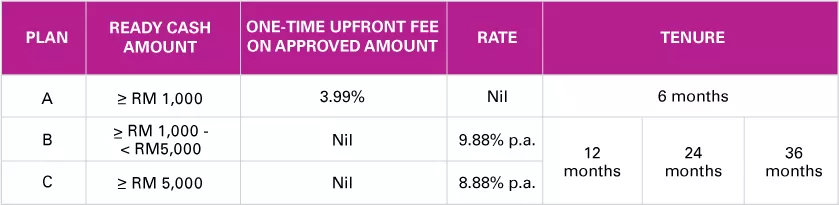

Get extra cash swiftly from your available credit limit with AEON Credit Card and repay in affordable monthly instalments. There is no processing fee and penalty for early settlement of your AEON Ready Cash plan.

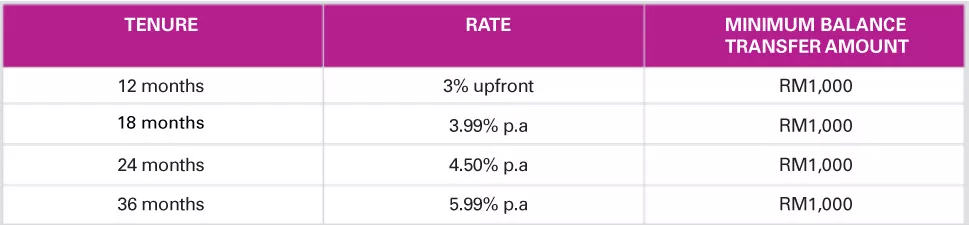

Consolidate your outstanding balances from other credit cards and transfer it to your AEON card at lower interest rate.

There is no processing fee and penalty for early settlement of your AEON balance transfer plan.

** If you make full monthly payment of your Balance Transfer instalments. For more Information, call 03-2719 9999.

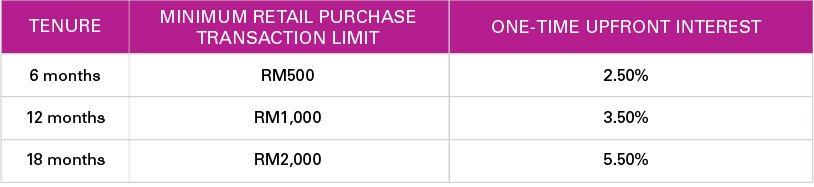

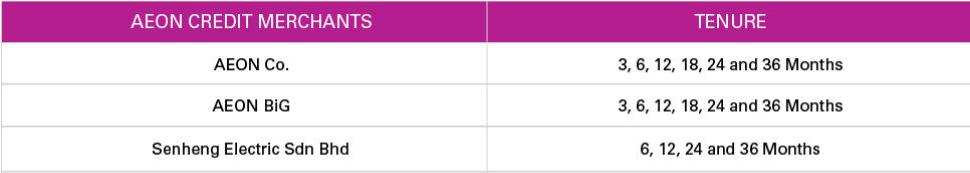

Transactions that have not been posted or stated in the current month’s statement can be converted to a Flexible Payment Plan after three working days from the date of purchase.

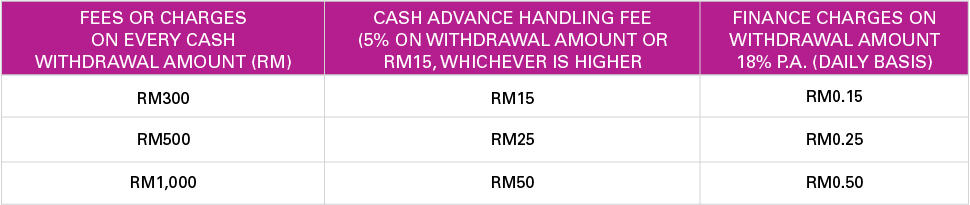

Stop worrying and start living your life! AEON Cash Advance offers instant cash anywhere, anytime. It’s that simple and convenient!

New credit limit to suit your standard of living

2-months for overseas travel, medical, education, hospitalisation, and compassionate purposes

Supplementary – RM150*

No processing/penalty fee for early settlement of your AEON Balance Transfer.

- You must always use reasonable precautions to prevent loss of your credit card and personal identification number (PIN). You are advised not to disclose the PIN or credit card details to unauthorized parties. If your credit card is lost or stolen, you must notify AEON Credit immediately as soon as reasonably practicable after having found that your credit card is lost or stolen, followed by a written confirmation together with a copy of a police report and provided that you have not acted fraudulently. Your maximum liability for unauthorized transactions as a consequence of a lost or stolen credit card shall be confined to a limit specified by AEON Credit.

- AEON Credit may resolve that your liability be limited to RM250.00 (or such amounts as may be determined by AEON Credit from time to time, with the approval of Bank Negara Malaysia, if required) subject to the following conditions: (1) you had in good faith and with reasonable care and diligence safeguarded your credit card or PIN from risk of loss, theft, unauthorized usage or disclosure; AND (2) you have not acted fraudulently; AND (3) you had immediately notified AEON Credit upon discovery of loss, theft, unauthorized usage of the credit card or PIN or non receipt of a renewal or replacement AEON Credit Card.

- AEON Credit has the right to set-off any credit balance in your account maintained with us against any outstanding balance in this credit card account.

- If you fail to abide by the terms and conditions of the credit card, we have the right to terminate your card.

No processing/penalty fee for early settlement of Ready Cash.

- No SST.

- No annual fee.

- No replacement card fee.

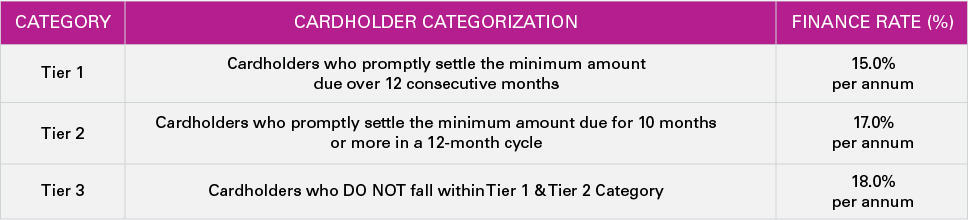

- BNM tiered interest rate (same as physical card).

FAQs

- Who is eligible to apply for this card?

Applicants must be Malaysian citizens or Japanese nationals, aged at least 21 years old, with a minimum

annual income of RM90,000. - How do I apply for this card?

Interested applicants may visit any AEON Credit Service branches nationwide, access our website at

myaeoncredit.com.my and AEON Wallet Malaysia app. - What are the documents required to apply for this card?

• MyKad photocopy (both sides), including Supplementary Card applicant(s) MyKad (if applicable).

• Valid Passport / MyPR (front & back) / Employment Pass / Work Permit.Employed:

• Latest 3 months’ payslip/Form E (with tax payment receipt) / EA / Latest 6 months’ payslip for commission earners.Self-Employed:

• Business Registration Certificate or Form 9/24/49

• Latest 6 months’ Company Bank Statement / Form B with tax payment receipt.Foreigners (Japanese only):

• Minimum latest 1 month payslip / Employment letter as proof of income.

• Copy of valid MM2H (Malaysia My Second Home) social visit pass. - What are the features and benefits of this card?

Cashback:

• 8% Cashback on spare parts, accessories, merchandise, and motor services.

• 8% Cashback on overseas spend.

• 2% Cashback for petrol.

• 2% Cashback for insurance transactions.

• 0.5% Cashback for other retail spend.Travel:

• 8x Complimentary access to Plaza Premium Lounge for Principal Cardholders and one (1) accompany guest per year.

• Travel Insurance coverage of up to RM500,000.

• Enjoy exclusive access for Visa Concierge.Other Value Added Benefits

Ready Cash:

• Convert your available AEON Credit Card limit into cash with no documents required, no processing fee, and no termination fee.Cash Advance:

• Perform cash withdrawals anytime at any AEON Credit or bank ATM (Automated Teller Machine) using your PIN.Balance Transfer:

• Transfer outstanding balances from other banks’ Credit Cards with no early settlement fees.Flexi Payment Plan:

• Convert your purchases into affordable monthly instalments. - How much is the annual fee charged for this card?

Principal Card – RM300

Supplementary Card – RM150

First year is waived. Subsequent yearly annual fee is waived upon achieving a minimum spend of RM42,000

per year.