AEON Member Plus Visa Card

It's not an ordinary member card

Overview

With our Cashback, you’ll be bringing home spare cash, not just groceries.

2X AEON Points

Earn 2X AEON Points for every RM1 payment in any AEON Stores, AEON BiG Hypermarkets, AEON MaxValu Prime, AEON Wellness and Daiso By AEON.

Instant Top Up

Top up easily at AEON Cashier Counter or via AEON Wallet

Tap to Pay

Tap to pay for a faster checkout. No PIN required for purchase of RM250 & below in a single receipt

Exclusive Benefits & Privileges

Exclusive benefits in AEON Stores, AEON BiG Hypermarkets, AEON MaxValu Prime, AEON Wellness & Daiso By AEON. Enjoy member privileges at over 200 merchants nationwide

Global Recognition

Earn 1X AEON Point for every RM1 payment overseas with Visa Card acceptance

Free Parking

Enjoy parking rebate up to 2 hours. Available at selected AEON Malls & AEON BiG Hypermarkets

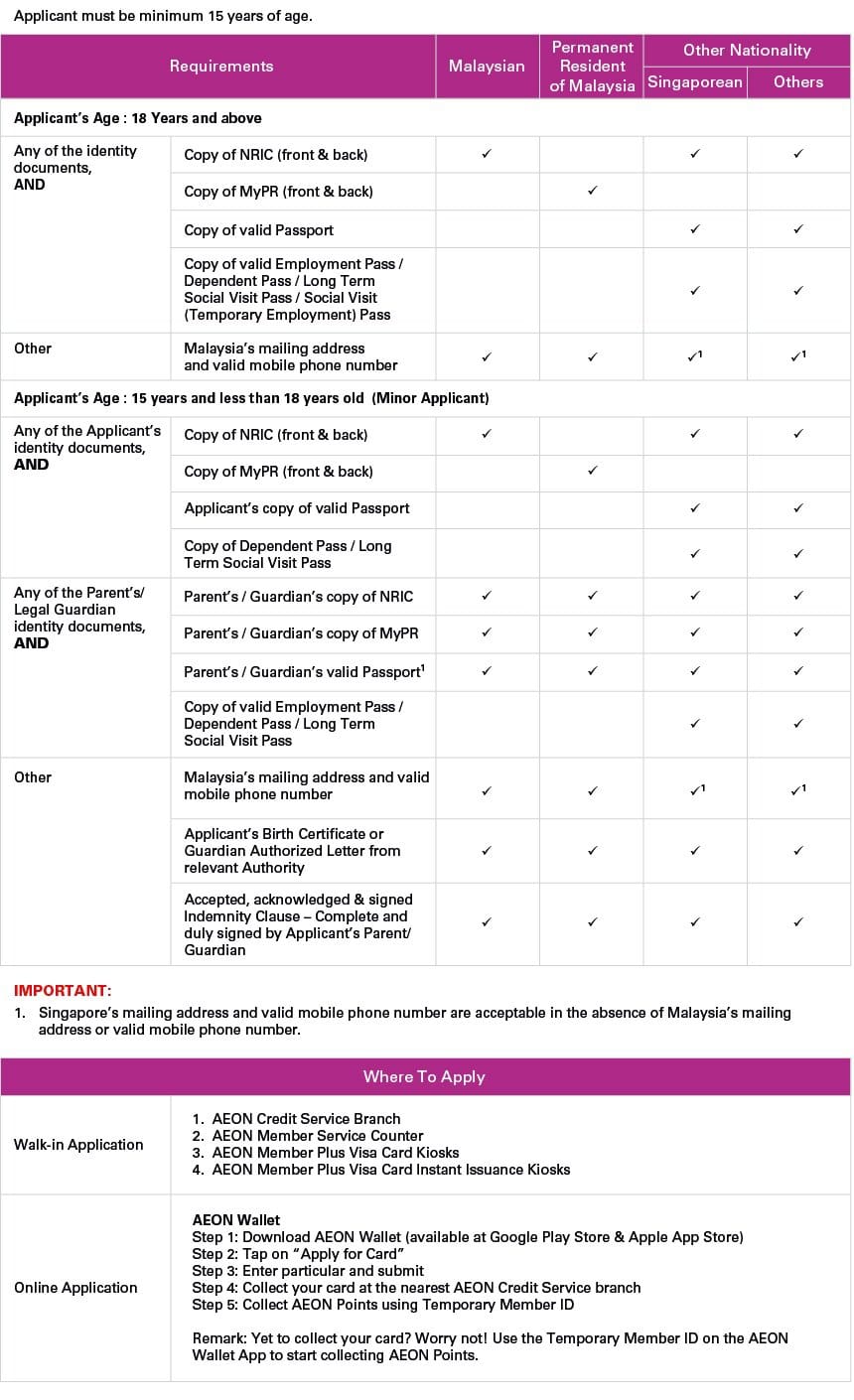

Prepaid Card Requirements

Eligibility & Documents

Features and Benefits

With our AEON Point, you’ll be bringing home spare cash, not just merchandise.

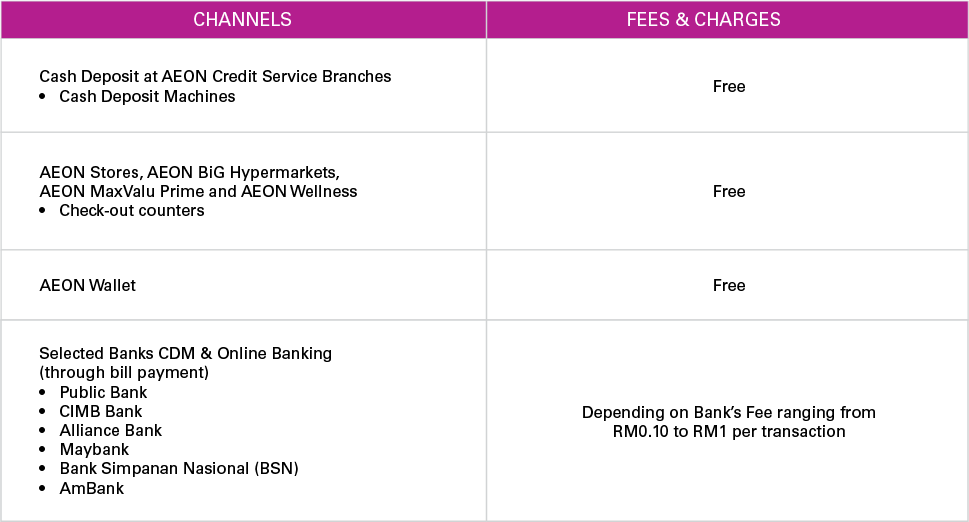

- AEON Credit Cash Deposit Machine.

- AEON Stores, AEON BiG Hypermarkets, AEON MaxValu Prime, AEON Wellness Cashier Counter.

- AEON Wallet Online Banking.

- Other Banks’ Online Banking.

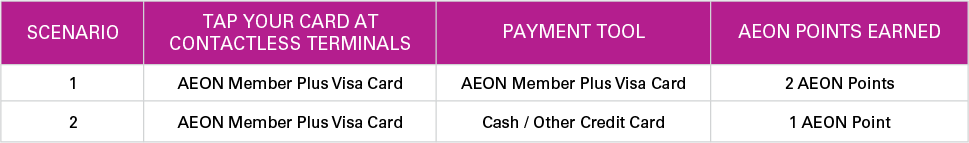

- Every RM1 = 2X AEON Points for member recognition and payment in all AEON Stores, AEON BiG Hypermarkets, AEON Maxvalu Prime, AEON Wellness and Daiso By AEON.

- Every RM1 = 1X for member recognition in all AEON Stores, AEON BiG Hypermarkets, AEON Maxvalu Prime, AEON Wellness and Daiso By AEON.

- Every RM1 = 1X for overseas transaction with VISA Card acceptance.

AEON Stores, AEON BiG Hypermarkets, AEON MaxValu Prime, AEON Wellness Cashier Counter : No Charges

AEON Wallet Online Banking: No Charges

Other banks’ online banking: ranging from RM0.10 to RM1.00 per transaction

Other banks’ ATM/PLUS Network: RM10 per transaction

Visa cash-out fee at participating merchants: No Charges

FAQs

Frequently Asked Questions

- What is AEON Member Plus Visa Card?

AEON Member Plus Visa Card is a Visa Electronic Money payment instrument with payWave functionality that contains a monetary value which is pre-loaded by the Cardholder. The value will be deducted from the Card whenever retail or withdrawal transactions are performed and spending is limited to the amount of money stored in the Card at the time of transaction. A preloaded amount is required before any transactions can be executed.

- Who is eligible to apply for this Card?

Applicants must be at least 15 years of age and there is no minimum income requirement. However, for applicant between the age of 15 to 17 years of age, an indemnity letter/clause is required to be completed and duly signed by applicant’s parent/guardian. A copy of applicants’ parent/guardian NRIC/Passport and applicant’s birth certificate or letter of Authorization for guardian by relevant authority must be submitted during Card application for minors. A copy of Passport or work permit is required for foreigners.

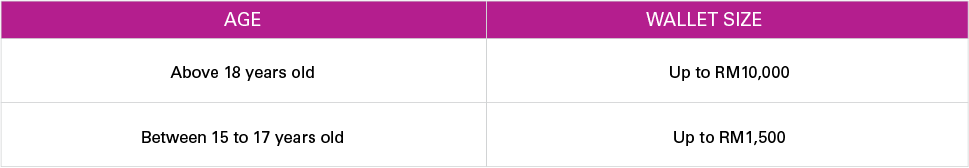

- What is the Wallet Size for the Card?

- Do I need to activate the Card before using?No. The Card is automatically activated when it is issued to you.

- Where can I use it?

This Card can be used both locally and globally where Visa Card is accepted including online purchases. Effective 1st June 2015, AEON Prepaid Card cardholders are only allowed to make domestic and 3D Secure (Online transaction with one time passcode/OTP authentication) transactions in order to safeguard and promote the card security features. In contrast, all Overseas and Non-3D Secure Card Not Present (inclusive of mail order and telephone order) transactions will be disabled by default. AEON Prepaid Card Cardholders may request to activate Overseas and/or Non-3D Card Not Present transactions by contacting us via Tel: 603-2719 9999, E-mail: customer.service@aeoncredit.com.my or log on to www.aeoncredit.com.my. However, during application of AEON Member Plus Visa Card, customer may choose to opt-in for this option.

- What is the difference from the existing AEON Prepaid MasterCard?

Existing AEON Prepaid MasterCard is a normal payment tool whereas AEON Member Plus Visa Card comes with new enhanced features for shopping convenience in AEON Stores, AEON BiG Hypermarkets, AEON MaxValu Prime, AEON Wellness and Daiso by AEON leveraging on some of the existing AEON Member and AEON BiG Member benefits and other privileges from participating Merchants to be notified from time to time.

- What are the enhanced features?

This product is convenient as you do not need to hold 2 Cards. You can experience a faster checkout process at cashier via payWave, there is no usage of cash & coins, and you will earn 2x the AEON Points as compared to cash payment. You will continue to enjoy AEON Member and AEON BiG Member benefits such as special member priced items and many more.

- What if I forget to top up sufficient balance for annual fee deduction?

Failure to deduct the annual fee due to insufficient balance will result in Cardholder’s AEON Points Programme being suspended until the Annual Fee is fully paid/deducted.

- Do I still need to come to AEON Member or AEON BiG Member Counter to pay for the annual fee?

To provide convenience to our customers, your annual fee will be deducted from your Card balance on the card anniversary date. An SMS will be send to you one (1) month prior to the expiry to remind you to top up sufficient balance in the card for the deduction, otherwise your Member function will be temporarily put on hold. AEON Points will be automatically used to redeem the annual fee in full or partially. The system will be configured to deduct from cash balance first. If the cash balance is insufficient, system will deduct the shortfall amount by way of redeeming AEON Points equivalent to the shortfall amount.

- Can I still use my existing AEON Member Card and AEON BiG Member Card?

No, please proceed to apply AEON Member Plus Visa Card as to enable you to continue enjoy the AEON Member benefits such as special member priced items and many more.

- How to ensure that I earn 2x AEON Points in AEON Stores, AEON BiG Hypermarkets, AEON MaxValu Prime and AEON Wellness?

You will be rewarded with 2x AEON Points for shopping at AEON Stores, AEON BiG Hypermarkets, AEON MaxValu Prime, AEON Wellness and Daiso by AEON. Just present your valid AEON Member Plus Visa Card before scanning your purchases and use it as a payment tool instead of cash. For every Ringgit spent, you will be entitled to two (2) AEON Points.

- Where else can I spend with AEON Member Plus Visa Card to earn AEON Points?

You will be rewarded with 1x AEON Point for every RM1 that you spend in overseas.

- Can I cancel my existing AEON Member Card upon applying for AEON Member Plus Visa Card?

No, you do not need to cancel AEON Member Card. It will be ceased of usage if you did not renew your membership upon expiry date.

- How to redeem my AEON Points earned through AEON Member Plus Visa Card?

You may perform AEON Points redemption via the AEON Credit website, AEON Wallet or any other medium which will be made available from time to time with denomination of every 200 AEON Points equivalent to Ringgit Malaysia One (RM1). Your total number of AEON Points will be converted into an equivalent cash value and credited into your Card Account.

- How long can I keep my AEON Points unredeemed?

Your AEON Point is valid for three (3) years from the year AEON Points have been accumulated. E.g. AEON Points earned from September 2016 to December 2016 is considered AEON Points earned in year 2016 and will therefore expire on 31st December 2019. You can track your AEON points expiry in your monthly statement through our website.

- If during payment transaction I realized there is no sufficient balance, what should I do?

We provide the convenience to top-up at the AEON Stores, AEON BiG Hypermarkets, AEON MaxValu Prime, AEON Wellness cashier counters, AEON Wallet and Cash Deposit Machines in AEON Credit branches.

- Does the AEON Member Plus Visa Card offer Supplementary Cards?

No. We do not offer Supplementary Cards. Every AEON Member Plus Visa Card is an individual card by itself for our customer convenience and benefit.

- Where and how can I reload/top-up?

- How do I use the Card with Visa payWave?

Just present your Card at any Visa Cards accepted outlets. This Card comes with Visa payWave function whereby you only need to ‘wave’ at the Visa payWave acceptance terminal if the transaction amount is lesser than RM250 or it can be inserted into a Card acceptance terminal just like a normal credit card transaction via a PIN transaction.

- Is there a limit on the value of goods that I can purchase with payWave technology?

In Malaysia, you can use your Visa payWave-enabled card for purchases of up to RM250 per transaction. No signature or PIN is required. However, for transaction above RM250, you will need to key in your 6-digit PIN for validation.

- Is there any chance that a payment amount may be deducted twice from my account?No. Visa payWave is designed to accept only one transaction per card at a time. As a security measure, each transaction must be either completed or voided before another one can take place.

- Can I unknowingly make a purchase if I walk past the reader?

No. Visa payWave is designed to ensure that the Cardholder is always in control. The retailer must first have entered the purchase amount for approval and your card must be in very close proximity to the card reader (within 4cm) in order for a transaction to take place. Terminals can only process one payment transaction at a time.

- If I still do not have the confidence in payWave technology, can I disable it? Or what other security features are there for the payWave function?

Yes, you may disable the function. However, to instill the Cardholders’ confidence in using the

contactless function, we provide:

i. Facility to enable/disable the contactless functionality.

ii. Facility to set a cumulative contactless transaction limit. For amount exceeding the preferred cumulative contactless limit, PIN is required for the transaction to be approved.

Both facilities above can be changed by log on to www.aeoncredit.com.my.

Steps to turn-off contactless functionality/set a lower cumulative contactless transaction limit:

1.Login to www.myaeoncredit.com.my

2.Under “My Account”, go to “Account Information”

3.Follow the instructions stated on the website.

AEON Member Plus Visa Card

It's not an ordinary member card